ARE YOU ANTICIPATING AN INHERITANCE IN AN AMOUNT THAT IS MAKING YOU FEEL UNEASY OR PRESSURED?

We can help provide you with immediate clarity on how to protect and grow your inheritance.

We specialize in helping people who have or are going to inherit money. We are known nationally for our experience in helping clients manage sudden wealth. If you are anticipating an inheritance in an amount that is making you uneasy or are feeling pressure because of the responsibility and are not sure what to do, we can help you get back in control and feeling confident.

From confusion to clarity. How we help people manage thier inheritance money

Clients who have inherited come to us looking for immediate clarity into what they have and a clear plan on how to preserve and manage their wealth going forward. We have created an individualized process which addresses each area of their finances. There are many legal, financial, and tax implications surrounding an inheritance that we can help you address. We work closely with our client’s other tax and legal advisors, or if they don’t have other advisors, we can help them build their team and make sure all of the issues have been addressed.

Up to

of Sudden Wealth is lost in the first year.

Don’t be a statistic. Get a Sudden Wealth expert on your team to help make your inheritance last a lifetime.

We are Real Fiduciaries.

This means we always put our client’s best interests first. A Real Fiduciary also means that we are not part-time fiduciaries. We put our client’s best interests first in all cases and at all times. Less than 8% of financial advisors are Real Fiduciaries.

You have enough to think about right now - trusting your financial advisor shouldn't be something you have worry about! Choose a fiduciary financial advisor to help manage your inheritance.

Nationally Recognized Sudden Wealth Expert

Robert Pagliarini, has nearly three decades serving clients who received a large inheritance. He offers financial planning and investment management for those who received a windfall. Robert is a CFP Ambassador, one of only 50 in the country, as well as an Enrolled Agent with the IRS. He has written several books and writes a financial column for Forbes.

Nationally-Recognized Financial Planner for Sudden Wealth Through Inheritance

Our founder Robert Pagliarini is nationally known for providing investment, legal, and tax advice to those with sudden wealth, such as receiving a large inheritance. He is also a CFP® Board Ambassador with dual masters and Ph.D., and has become the go-to expert for serving sudden wealth recipients. He is called upon by the media for his insight into the financial and psychological issues related to navigating life after receiving an inheritance.

Manage and track your inheritance 24-7

Whether you were prepared to receive the inheritance or it came as a total shock - we can help you protect and grow your inheritance no matter where you reside. We utilize a sophisticated financial planning platform and can handle all paperwork, meetings and more 100% online.

Compassionate advice for inheritance recipients

If you received an inheritance in an amount that is making you uneasy and you are not sure what to do, we can help you get back in control and feeling confident. You need a financial advisor who has your best interest. Not only will we help safeguard your inheritance - we'll help you deal with the emotional aspects of sudden wealth.

I just inherited money - now what?

With nearly three decades of experience giving inheritance guidance, here are the questions we answer most.

- Will the money I receive from the inheritance affect my taxes?

- I’m getting the inheritance in a trust. Does this mean I can’t use it how I want?

- The inheritance trust requires a co-trustee. What is their role?

- How can I best integrate this new money into my existing assets?

- How much of my inheritance can I afford to give?

- Will the money I receive from the inheritance affect my taxes?

- I’m getting the inheritance in a trust. Does this mean I can’t use it how I want?

- The inheritance trust requires a co-trustee. What is their role?

- How can I best integrate this new money into my existing assets?

- How much of my inheritance can I afford to give?

- Should I tell my kids about the inheritance, and if so, how much should they know?

- What is the best way to invest the inheritance?

- How do I leave enough assets to my kids that they can do anything, but not so much they can do nothing?

- Do I have enough money to quit my job, buy a new house, move after now that I have a large inheritance?

- Should I tell my kids about the inheritance, and if so, how much should they know?

- What is the best way to invest the inheritance?

- How do I leave enough assets to my kids that they can do anything, but not so much they can do nothing?

- Do I have enough money to quit my job, buy a new house, move after now that I have a large inheritance?

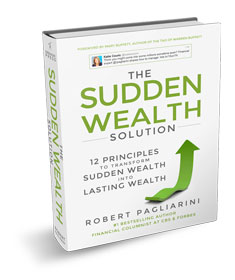

The Sudden Wealth Solution Book

12 Principles to Transform Sudden Wealth into Lasting Wealth - A must-read for those who received a large inheritance

Robert Pagliarini, founder of Pacifica Wealth Advisors, a wealth management firm in Orange County, CA - authored The Sudden Wealth Solution. Sudden wealth is often portrayed as creating dire consequences for its recipients, but it can be an amazing opportunity that improves your life and those around you. I’ve worked with enough clients who have received a large inheritance, over the years to see patterns – what works and what doesn’t. With proper guidance and a willingness to stick to the 12 Principles outlined in The Sudden Wealth Solution, you can avoid the common pitfalls that so often destroy inheritance money and transform your windfall into lasting wealth.