Hello. My name is Robert Pagliarini. I have a financial planning and investment management firm that focuses on retirement planning and working with clients faced with significant financial transitions such as retirement, the sale of a business, inheritance, stock options, and other sudden wealth events.

I have a Ph.D. in financial and retirement planning. Additionally, I am a CERTIFIED FINANCIAL PLANNER® practitioner and have a Master’s Degree in Psychology. I've written five personal finance books and have written a personal finance column for Forbes, CBS, and other publications.

Always learning

Sudden wealth is an area with always-changing tax, legal, and financial issues. I’ve made it my mission to become a life-long learner and student, sometimes to the dismay of my family. I have several photos of me on my honeymoon lounging poolside reading a thick book on wealth management. When on a non-profit trip to Myanmar, I studied on the plane for the IRS Enrolled Agent exam. When on vacation in Europe with my wife, I was caught highlighting a journal column on the taxation of lawsuit damages. I have a large purple folder marked “To Read,” filled with columns and papers on investing, taxes, estate planning and a myriad of financial topics. I bring this folder nearly everywhere, because I'm dedicated to always learning for myself, and the benefits I can pass onto my clients.

I love to learn, and I think it is a necessity if you want to provide the best advice and current strategies to clients. I am currently a CERTIFIED FINANCIAL PLANNER® practitioner and I earned a Ph.D. in financial and retirement planning from The American College where I studied and conducted research on retirement income distribution planning, behavioral finance, and investment strategy.

Psychology of money

Although I’ve spent a great deal of time learning the financial, tax, and legal aspects of sudden wealth, I would be doing my clients a huge disservice if I stopped there. I tell my clients that successfully managing sudden wealth is often less, at least initially, about managing the money and more about managing emotions and relationships. The sad riches-to-rags tales you hear are rarely from a single bad investment or from paying too much tax. The real cause is how money changes us and how it changes those around us. Although I’m a financial advisor, I learned quickly that if I was going to really help my clients, I needed to understand the psychology of money, motivation, emotions, and relationships. To that end, I went back to school and earned a Master’s Degree in Psychology with an emphasis in marriage and family therapy. This program required I conduct hundreds of hours of face-to-face counseling. To better connect with clients, I’ve graduated from business and personal coaching programs as well as workshops in Solution Focused Therapy and others. My goal is not to be a therapist for my clients. My goal is to better understand what drives them and to help them make the best financial decisions they can.

Love of teaching

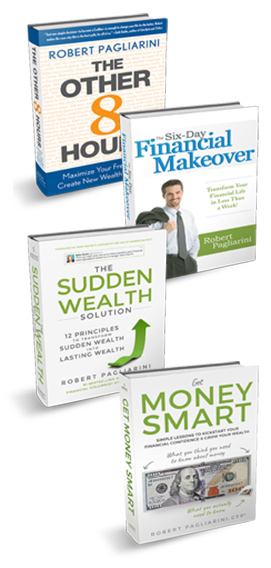

I’ve written five personal finance books. My most recent is Badass Retirement: Shatter the Retirement Myth & Live with More Meaning, Money, and Adventure (Harbinger Press, 2023). This book was fun to write! It's all about how to create your best life in retirement. My first was the #1 bestselling The Six-Day Financial Makeover: Transform Your Financial Life in Less Than a Week (St. Martin’s Press, 2006). I wrote this as a general guide for anyone who wasn’t quite sure what they should be doing with their finances. Although the book is almost a decade old, the advice is still as relevant today as it was when I wrote it. My second book was The Other 8 Hours: Maximize Your Free Time to Create New Wealth & Purpose (St. Martin’s Press, 2010). This book was a departure from traditional personal financial advice and was more focused on investing your human capital rather than investment capital. My third and most specialized book is called The Sudden Wealth Solution: 12 Principles to Transform Sudden Wealth Into Lasting Wealth (Harbinger Press, 2015). This book focuses on the financial, emotional, and relational issues surrounding sudden wealth. My most recent book is Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Growth Your Wealth (Harbinger Press, 2018). This book provides concise and easy to understand personal finance lessons with humor and stick figures.

Daddy on TV

Over the years, I’ve had the privilege of appearing on Dr. Phil, 20/20, Good Morning America, Fox Business, Katie Couric, and many others. I always have a good time on these shows, and my daughter gets a kick out of seeing Daddy on TV.

Many adventures

Traveling around South East Asia over the past several years ignited the adventurer in me. A couple of times a year, I travel to exotic places around the world. I’ve climbed Mt. Kilimanjaro, hiked the Inca Trail to Machu Picchu, hang-glided in Brazil, ice-climbed in Colorado, camped at the bottom of the Grand Canyon, mountain biked in Burma, trekked to the Great Wall of China, explored the jungles of Thailand and Malaysia, and completed an Ironman with clients (yes, they beat me but I was just happy to finish!). Not all clients are interested in these trips, but they are always welcome.

My wealth management firm

I get up each morning with the unwavering mission to help my clients make more money through low-cost investing, reduce the taxes they pay, and implement comprehensive and creative financial strategies tailored to meet their needs.

I am honored that our clients put their trust in me to help them create a better future. I am passionate about always doing what is right, honest, and ethical for my clients – putting their needs above all others. And I never forget that I am here for my clients and because of my clients.