A Fiduciary is someone who is legally obligated to give you advice that is in your best interest.

It doesn’t make sense to pay for financial advice when the advice doesn’t have to be in your best interest. Period.

A Fiduciary is someone who is legally obligated to give you advice that is in your best interest. Yes, this means there are financial advisors (the majority of them, actually) who get paid by their clients and who do not have to put their client’s interests ahead of their own.

Ridiculous.

Ludicrous.

Preposterous.

Why should you choose a fiduciary financial advisor?

A Fiduciary financial advisor is legally obligated to give you advice that is in your best interest.

It makes little sense to pay for financial advice when the advice doesn’t have to be in your best interest.

Most financial advisors are not fiduciaries. They get paid by their clients and do not have to put their client’s interests ahead of their own.

Ridiculous.

Ludicrous.

Preposterous.

Why would you pay someone for advice when what the advisor is recommending may be in their best interest?

Imagine going to a marriage therapist and paying her to help you improve your marriage but knowing she is also a divorce lawyer who can help you get divorced if your marriage doesn’t go well. Why in the world would you pay for her marital “advice”?

I hope one day all financial advisors will be fiduciaries and put their clients’ interests first, but until then, this should be your first question to any potential financial advisor.

HOW TO HIRE A FIDUCIARY FINANCIAL ADVISOR?

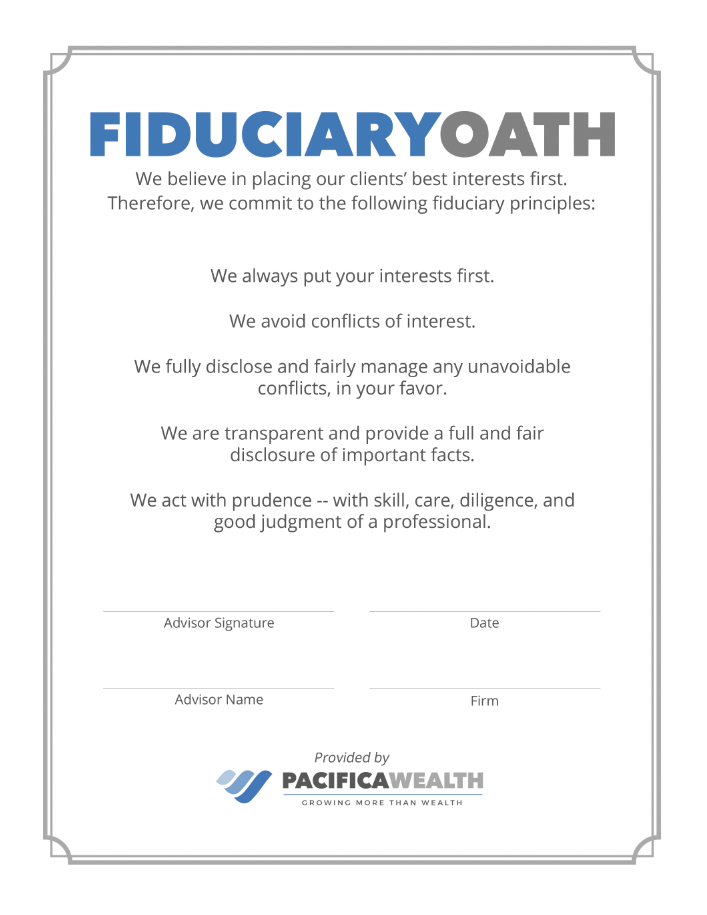

Download a fiduciary oath and share it with potential financial advisors to help protect your best interests.

Taken from the Top 10 Questions To Ask Your Retirement Financial Advisor by Robert Pagliarini, PhD, CFP®, EA, president and founder of Pacifica Wealth Advisors.

Learn more about what about what a fiduciary is, and why you should hire one as your financial advisor on NAPFA – Fiduciary 101.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.