This is a phrase you might hear from time to time.

Dollar cost averaging. It’s kind of a cool technique, and you should be somewhat familiar with what it is, as it can help you make more money as an investor.

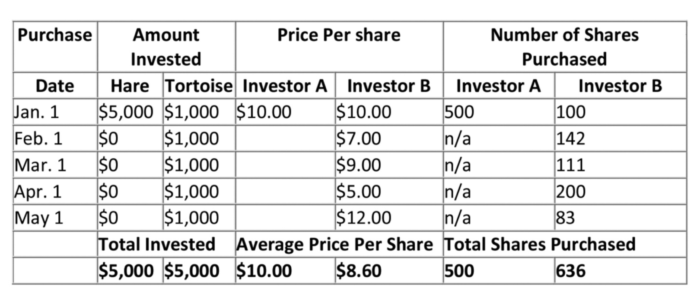

Let’s look at two investors…

Think of these two investors in terms of the fable The Tortoise and the Hare. Remember that one? The tortoise and the rabbit decide to race each other. The rabbit, obviously much faster, takes off and is in the lead. The tortoise, being a tortoise, is quite slow. He plods along in the race. Who wins? Spoiler alert. In a flash of literary surprise, the slow plodding turtle wins the race! Let’s see how our investors do:

With dollar cost averaging, you are taking the same dollar amount and investing it over time into a stock with the goal of buying into the stock at different prices. In this example, the tortoise wins! Yay! But honestly, I always hated that story. Would the hare really be so stupid to take a nap right before the finish line? So, let’s look at another example of what could happen in the real world.

And just like that, our sprightly bunny wins this race! Suck on that, shell boy.

So what is an investor to do?

Sometimes you may not have a wad of cash to invest at once. For example, people who contribute to a 401(k) are really dollar cost averaging. With every paycheck throughout the year, they are taking part of their income and investing.

But sometimes you may have a lot of cash. For example, if you receive an inheritance or receive a lawsuit settlement. In these cases, even though the stock could go up and up and up like in our last example, investors like to spread out their buys over time. They don’t want to make a single purchase, but would rather gradually get into the stock.

There are pros and cons to both approaches…

For this lesson, the takeaway is dollar cost averaging is a complex sounding phrase for simply investing the same amount of money into the same investment over a period of time.

The proceeding blog post is an excerpt from Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Grow Your Wealth, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.