Social Security benefits have increased 1.7% this year. This doesn’t come close to the 3.6% boost retirees got for 2012, but it does mark the second straight annual cost-of-living adjustment. (After a hefty 5.8% COLA for 2009, there were no COLAs for 2010 or 2011). So for 2013, the average monthly Social Security payment going…

Read MoreDo your employees have a company retirement plan? If they do, then you have a fiduciary responsibility to them. Ignoring it to any degree could really cost you. Maybe you’ve heard about some of the settlements linked to charges of negligence or mismanagement. They can be painful for businesses big and small. In 2010, a…

Read MoreHere’s a simple financial question: who is the beneficiary of your IRA? How about your 401(k), life insurance policy, or annuity? You may be able to answer such a question quickly and easily. Or you may be saying, “You know … I’m not totally sure.” Whatever your answer, it is smart to periodically review your…

Read MoreIn March, Social Security will stop mailing checks to all but a small percentage of retirees. About 5 million seniors still get their benefits in the form of a check – and if you are one of them, what alternatives do you have for the future? The new options: direct deposit or a Direct Express…

Read MoreThe IRA that changed the whole retirement savings perspective. Since the Roth IRA was introduced in 1998, its popularity has soared. It has become a fixture in many retirement planning strategies, because it offers savers so many potential advantages. The key argument for going Roth can be summed up in a sentence: Paying taxes on…

Read MoreIf your loved ones have invested, saved or insured themselves to any degree, you may be named as a beneficiary to one or more of their accounts, policies or assets in the event of their deaths. While we all hope “that day” never comes, we do need to know what to do financially if and…

Read MoreOn March 1, $85 billion in federal budget cuts are supposed to take place – and it doesn’t look like they will be delayed any longer. Congress went on recess last week, so there was no concerted legislative effort to stave them off (in the manner of the fiscal cliff deal). At this point, the…

Read MoreEvery year, taxpayers leave money on the table. They don’t mean to, but as a result of oversight, they miss some great chances for federal income tax deductions. While the IRS has occasionally fixed taxpayer mistakes in the past for taxpayer benefit (as was the case when some filers ignored the Making Work Pay Credit),…

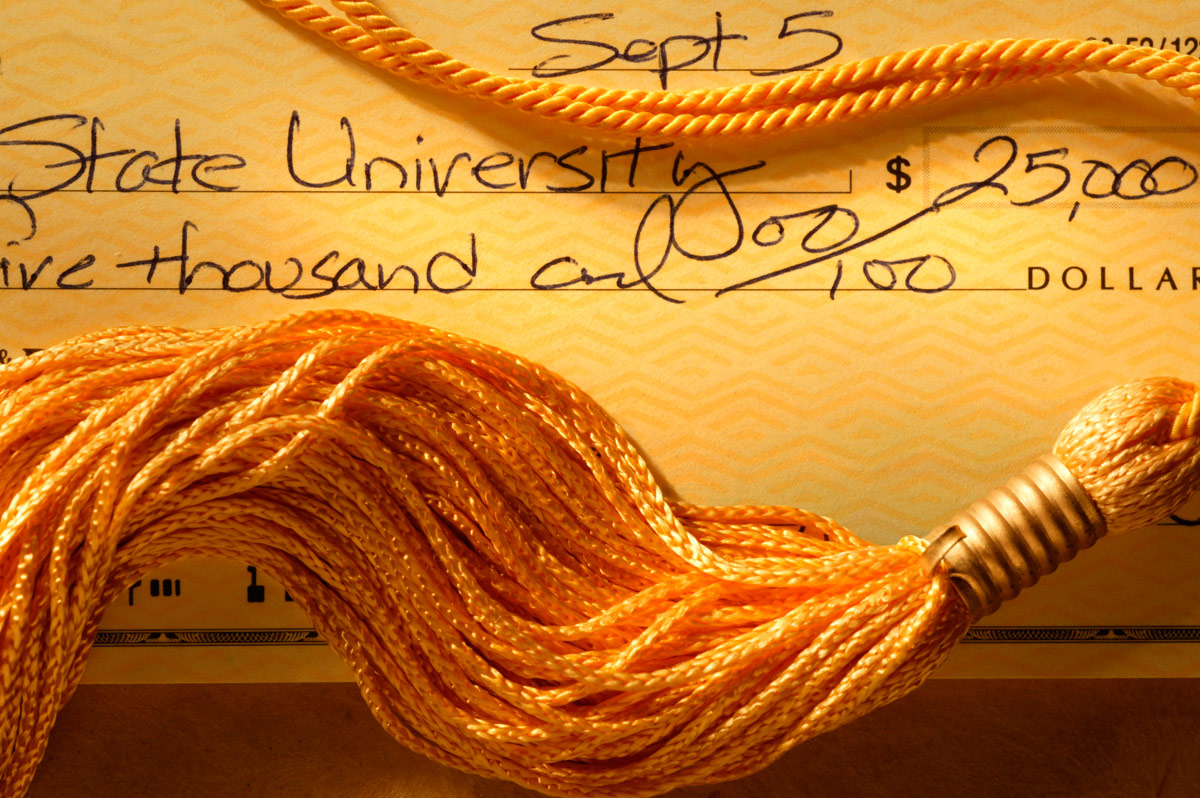

Read MoreHow expensive will college be tomorrow? The Department of Education projects that by 2030, the tuition cost of obtaining a four-year degree at a public university will surpass $200,000. Staggering? Indeed, but college is plenty expensive already. For the 2017-2018 school year, tuition averaged $25,290 a year at public colleges and $50,900 a year at…

Read MoreShould your refund be saved? According to a TD Ameritrade poll, 47% of U.S. taxpayers expect a refund this year. What do they plan to do with the money? The answers may surprise you. While 15% of the survey respondents indicated they would spend their refunds on discretionary purchases, 47% said they would save the…

Read More