An IRA is a retirement savings account, right? Indeed it is. IRA stands for Individual Retirement Arrangement. Even with that definition, however, there is no prohibition on using an IRA to save for other purposes, such as funding a college education.

Why would anyone choose an IRA as a college savings vehicle? At first glance it may seem strange, since there are a couple of types of investment accounts dedicated to that goal in the first place. On closer inspection, IRAs – especially Roth IRAs – present some features that may be quite attractive to the parent or grandparent seeking ways to build education savings.

Flexibility. Parents are urged to save for their children’s college educations as soon as possible … but what if their children end up spending little or no time in college? Some young adults do start careers or businesses without any college education. Some simply have no interest in going to school any longer. Another, more pleasant circumstance worth mentioning: what if a child ends up getting a significant college scholarship, even a full ride?

In the event that these things happen, parents or grandparents who long ago opened a conventional college savings account may face a financial dilemma. Withdrawals from these conventional college savings plans are tax-free as long as they are used for qualified educational expenses, but if the funds are withdrawn other purposes, the distribution is regarded as fully taxable income (and the account gains are subject to a 10% penalty). Sometimes you can transfer assets in one of these conventional college plans to another family member, but some families do not have that choice.

As an IRA can be used to build retirement savings as well as a college fund, it offers a family flexibility in the face of such uncertainty. If the assets saved and invested for college end up being nice but not really necessary, those invested assets can serve as retirement funds.

Tax-deferred growth & the possibility of a tax-free withdrawal. You probably know the basic distinction between a traditional IRA and a Roth IRA: the former permits tax-deductible contributions as a tradeoff for eventual taxable withdrawals, while the latter offers no tax deduction on contributions in exchange for tax-free withdrawals later (provided an investor follows IRS rules). Either IRA gives you tax-deferred growth of the invested assets.

Now, can you open a Roth IRA, own it for five years or more and withdraw its assets tax-free even if you use the money for something other than your retirement? If that something is your child’s college education, the answer is (a qualified) yes.

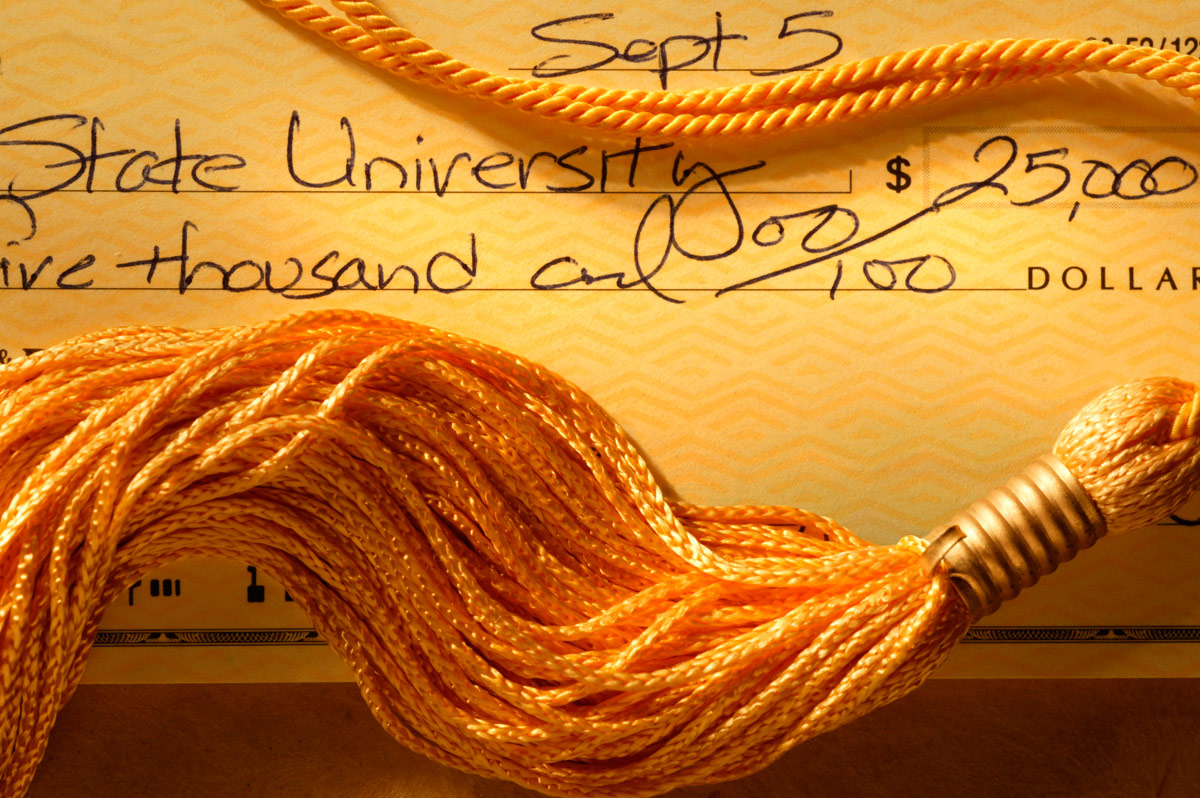

Withdrawals from Roth (and for that matter, traditional) IRAs face no withdrawal penalties if the money withdrawn is used for qualified educational expenses. Does this mean you can take $100K out of a Roth IRA today and use it to pay for your child’s college education? Probably not that large an amount, as some restrictions apply.

Roth IRA withdrawals are regarded by the IRS as a return of contribution first, with account earnings coming out next. If you own a Roth IRA and are younger than 59½, or are older than 59½ but have owned your Roth IRA for less than five years, your Roth IRA’s earnings are ordinary, taxable income if withdrawn. Roth IRA contributions may be withdrawn tax-free at any age. So if you have contributed, say, $45,000 to a Roth IRA, as much as $45,000 from that Roth could be taken out tax-free and used for qualified educational expenses.

One other note about taxes that pertains to all this: eight states offer no tax deduction on funds contributed to a conventional college savings plan. If you live in one of those eight states (Massachusetts, New Jersey, and California among them), then idea of withdrawing Roth IRA contributions tax-free at some point for education purposes may seem more attractive.

Not considered an asset on the FAFSA. When students apply for college aid, they routinely fill out the Free Application for Federal Student Aid (FAFSA), which helps the federal government figure out the Expected Family Contribution (EFC), or the degree of college costs the family finances can handle. Conventional college savings accounts are counted as assets on the FAFSA in determining the EFC, but IRAs and other retirement accounts are not.

What are the shortcomings of building college savings with an IRA? First, this idea may not work for retirees, as you must have “taxable compensation” to make Roth IRA contributions and you cannot make traditional IRA contributions past age 70½. Phase-outs on for high earners may reduce or even prohibit annual Roth IRA contributions for some. Lastly, some of the conventional college savings vehicles have no annual contribution limits, while the annual contribution limit for Roth and traditional IRAs is currently set at $6,000 ($7,000 if catch-up contributions are included). Even so, families who seek more flexibility in their college savings options may see an IRA, particularly a Roth IRA, as an intriguing potential college savings vehicle.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.