Bonds don’t have to be boring.

Just like you can split up stocks into different categories, we can do the same thing with bonds. And by doing this, it can tell us a great deal about our investments and how we are invested.

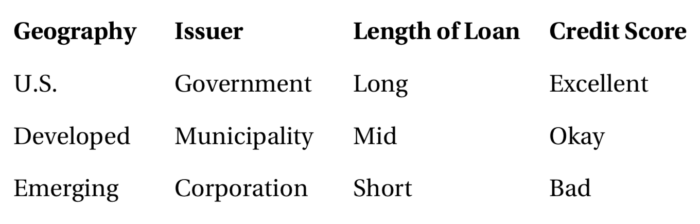

Here are the main sub-asset classes when it comes to bonds:

Good news! You already have the geography types down. U.S. just means the bonds are from the U.S. Developed means bonds are from other countries outside the U.S., but they are more developed like the U.S., countries such as Canada, France, Japan, England, and Australia. Then you have emerging markets. These are also countries outside the U.S., but are not quite as developed, such as Brazil, India, Thailand, and Turkey.

But let’s look at the Issuer category. What does that mean, Issuer? It means who you are lending the money to. That is, who is borrowing the money by issuing a bond? Well, there are a lot of different groups out there that would love to borrow money from you. Here are the big three that issue bonds: Governments, Corporations, and Municipalities.

People are often surprised that governments borrow money, but it’s true!

They borrow big time! The U.S. government borrows a boat- load of money all the time. How much do we owe? Take a guess. $1 million? $100 million? Not even close. We owe $18 trillion!

So do governments borrow money? Well, if you consider $18 trillion to be money, then sure, I would say they do. And it’s not just the U.S. government; countries around the world borrow, too. But why? The short answer is they need the money. It costs a lot of money to have a military, to pay for disaster relief, IRS employees, and the FBI.

But one day, a group of people got envious of all this borrowing. They wanted to borrow money, too, but they were just a little city. They weren’t a big country. No problem! States and cities, also called municipalities, can borrow as well. Yes, that includes you, Los Angeles, Texas, and Chicago, but also the little guys out there, such as Billings, Montana; Chattanooga, Tennessee; and Rhode Island. They can all issue bonds and borrow money. But again, why would they want to borrow? Lots of reasons. They may want to build a new bridge or road. They may want to construct a new city hall or football stadium.

And then finally, we can’t forget the last of the big three, corporations.

That is, companies. They borrow a lot of money, too. Companies like Wal-Mart, Microsoft, and Yum Brands, the company that owns KFC, Pizza Hut, and Taco Bell.

Who cares? Why are we always trying to put things into different boxes?

Because we can understand a great deal about a bond just by knowing if it is a government, municipality, or corporation that issues it.

The last two categories, you understand. The length of the loan, also called the term, is when you will get back the money you lend, and it’s either a long time or a short time from now. Then you have credit score, or what we call credit quality. What is the likelihood you are going to get your money back?

That’s it. That’s how you can split up and think about different types bonds.

The proceeding blog post is an excerpt from Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Grow Your Wealth, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.