Don’t Kill The Chicken

So I’m 15 minutes into an explanation of what I think is a pretty important and complicated subject when my client stops me mid-sentence. She says, “So basically, don’t kill the chicken.” I pause. I pause some more. She looks at me like I’m an idiot, and I look at her like she’s crazy. Guess who was right?

Imagine you just worked your last day…

You are now officially retired! The smile on your face knowing you’ll never have to work again quickly turns to a frown as you start to worry about paying your bills.

Let’s say you have a portfolio with $1 million. It seems like a lot of money. How much can you take each year? Well, if you took $1 million a year, you’d be broke in just one year, but I’m sure you’d have one hell of a year!

Your portfolio will produce for you, but if you spend it down, it can’t keep up.

Broke in a year doesn’t sound like such a good retirement plan. What if you took $1 a year? Your portfolio would last at least 1 million years, right? But can you really live on just $1 a year?

Okay, well, what if you wanted to take some amount between $1 and $1 million a year? And that’s the big question. A lot of times, someone will ask, “How much can I take out of my investments each year and not really risk spending down my portfolio?” If you’re retired, the last thing you want is to run out of money. But at the same time, you’ll probably need to take some money out of your investments to live on.

The question is how much can you take out and be fairly safe that you don’t spend down all your investments?

There are a lot of factors that go into the answer, including how your investments are allocated and your age. But, we have a pretty good rule of thumb when it comes to answering the question, “How much can I take out from my portfolio without it running out of money?”

The rule of thumb is the 4% rule.

You can be fairly safe taking out 4% from your portfolio a year – sometimes more, but generally, it’s around 4%. That means, you could take out $40,000 from your $1 million portfolio each year and be pretty confident that you will not run out of money.

And that brings me back to my client and the chicken.

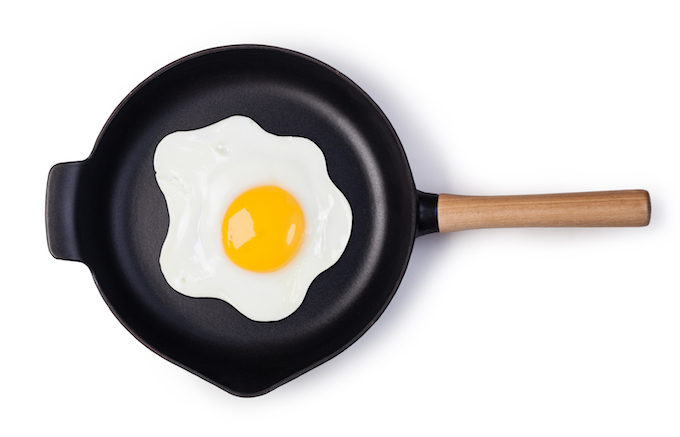

My client explained, “Your chicken lays eggs. Those eggs are like income. If you try to get in there and get more eggs, you’ll kill the chicken, and then she can’t produce any more eggs for you.” How cool is that metaphor? Your portfolio will produce for you, but if you spend it down, it can’t keep up.

So, in the end, my client was right and I was the idiot. It was totally worth it, though, to hear her chicken and egg metaphor. It is a great explanation and I’ve used it ever since.

The proceeding blog post is an excerpt from Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Grow Your Wealth, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.