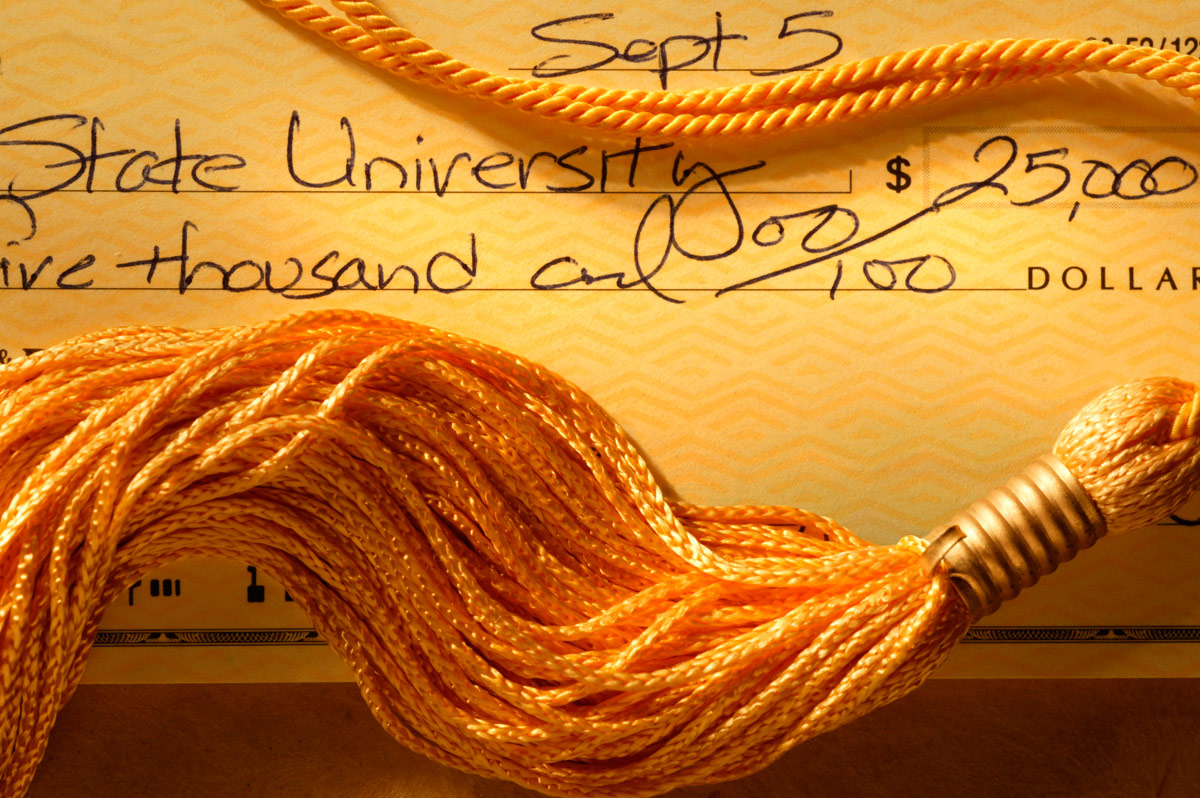

How expensive will college be tomorrow? The Department of Education projects that by 2030, the tuition cost of obtaining a four-year degree at a public university will surpass $200,000. Staggering? Indeed, but college is plenty expensive already. For the 2017-2018 school year, tuition averaged $25,290 a year at public colleges and $50,900 a year at private colleges. It is little wonder that student loan debt exceeds credit card debt today.

How can you start saving to meet those costs today? With interest rates being what they are, don’t look to a garden-variety savings account. Even if current interest rates soon ascend to 2% or 3%, you would be at a disadvantage even if the bank account was large as tuition costs are climbing more significantly than inflation.

The message is pretty clear: to meet college costs, you need either a prepaid tuition plan or a savings vehicle that taps into the power of equity investing. Let’s look at some options.

Prepaid 529 plans. Offered by states and public colleges, these plans let you buy tomorrow’s tuition with today’s dollars. You purchase X dollars of tuition today, and that is guaranteed to pay for an equivalent amount of tuition in the future.

You can do this in two different ways. Some of these prepaid plans are unit plans, in which you pay for X number of college credits or units now with a promise that the same amount of credits will be covered in the future. In other words, you’re locking in tuition at current rates.

As an example, let’s say a year of college at Hypothetical State University requires 36 units. Mom and Dad use a unit plan to pay $7,500 for those 36 units now for their 6-year-old daughter. In turn, the plan promises to pay whatever those 36 units cost when she starts her first semester at Hypothetical State 12 years from now, even though it might be much more.

The other prepaid 529 plan variant is the contract plan, or guaranteed interest plan. In these prepaid plans, you make a lump sum contribution (or arrange recurring contributions), essentially buying X number of years of tuition. In turn, the plan guarantees to cover this predetermined amount of tuition expenses in the future.

Usually, beneficiaries of prepaid tuition plans must be residents of the state offering the plan, or prospective students of the college offering the plan. In the wake of the recession, some of these plans are not accepting new investors as some states are worried about underfunding.

529 college savings plans. These state savings plans allow you to invest to build college savings rather than simply prepay them. Plan contributions are typically allocated among funds, and possibly other investment classes; the plan’s earnings grow without being taxed. The withdrawals aren’t taxed by the IRS either, as long they pay for qualified education expenses.

You can contribute up to six-figure sums to these 529 plans – there’s a lifetime contribution limit that varies per state. Most of them are open to out-of-state residents. If the market does well, you can harness the power of equity investing through these plans and potentially make a big dent in college costs.

There are two caveats about 529 plans. Should you elect to withdraw money from a 529 plan and use it for non-approved purposes, that money will be taxed by the IRS as regular income – and you will pay a penalty equal to 10% of the withdrawal amount. 529 balances can also negatively affect a student’s chances for need-based financial aid. In a given school year, that eligibility can be reduced by up 5.64% of your college savings.

Coverdell ESAs. Originally called Education IRAs, Coverdell Education Savings Accounts offer families some added flexibility: the withdrawals may be used to pay for elementary and secondary school expenses, not just college costs. These are tax-deferred investment accounts, like 529 savings plans. Unfortunately, the current annual contribution limit for a Coverdell is $2,000. Any remaining account balance must generally be withdrawn within 30 days after the beneficiary’s 30th birthday, with the earnings portion of the balance being taxable.

Roth IRAs. Yes, it is possible to use a Roth IRA as a college savings vehicle. While the IRA’s earnings will be taxed, withdrawals used to pay for qualified college expenses will not be taxed and will face no IRS penalty. Additionally, if your son or daughter doesn’t go to college or comes into some kind of windfall that pays for everything, you end up with a retirement account. While Roth IRA balances don’t whittle away at a student’s chances to get need-based financial aid, the withdrawal amounts do come under the category of untaxed income on the FAFSA.

Life insurance. Some households look into so-called “cash-rich” life insurance – whole or universal life policies – as a means to fund a college education. This requires a big head start, as when you buy one of these policies the bulk of your premiums go toward the life insurance part of the contract for several years and you have yet to build up much cash value. The big feature here is that most colleges don’t consider life insurance when evaluating financial aid applications.

Would a trust be worth the expense? Rarely, families set up tax-advantaged trusts for the purpose of college savings. In the classic model, the family is incredibly wealthy and the kids are “trust-fund babies” bound for elite and very expensive schools. Unless you have many children or your family is looking at potentially exorbitant college costs, a trust is probably overdoing it. The college savings vehicles mentioned above may help you save for education expenses just as effectively, all without the administrative bother associated with trusts and the costs of trust creation.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.