You entire financial health can be summed up with one number.

This one number reflects all of the financial decisions you’ve ever made. That number is your net worth. For such a powerful number, you would expect a long and complicated calculation; however, it is easy to calculate your net worth.

Large well-known companies such as Ford and Disney constantly calculate and monitor their net worth, as do smaller less known companies. Companies calculate their net worth a little differently than you will. Companies list everything they own—from the company cars to the office equipment to their unsold products to their savings account balances. If they own it, they list it. Technically, this is how you calculate net worth but you’re going to calculate your net worth a little bit differently.

Instead of listing everything you own—clothes, furniture, and electronics—list only things that you could sell easily without hosting a yard sale. There are three categories of things you can count as what you own:

1.) Savings/Investments. Certainly include all of your savings, checking, certificate of deposit, emergency reserve, investment, IRA, and 401(k) account balances. Use the full account balance for each account. Also include any loans you’ve made to others if there is a good chance you’ll get your money back.

2.) Large assets. This category includes such assets as your home, rental property, automobiles, boats, expensive jewelry, etc. Value these items at their current market value—that is, list the price that you could get if you sold the item today. For example, if you bought a $25,000 car last year, don’t list this asset at $25,000 because there’s no way you could sell it for that today. Check the Kelly Blue Book (www.kbb.com) value for a more accurate resale value. Likewise, if you bought a house five years ago for $325,000, don’t list it at $325,000 since it probably has appreciated in those five years. List the amount that you could sell it for today. Check what houses like yours have sold for on the Internet or ask a real estate agent if you’re not sure the value of your house.

3.) Other appreciating or income-producing assets. Chances are you won’t have anything to list in this category, but if you have assets such as a coin or stamp collection or receive royalties or license fees, list these assets here.

Now it’s your turn.

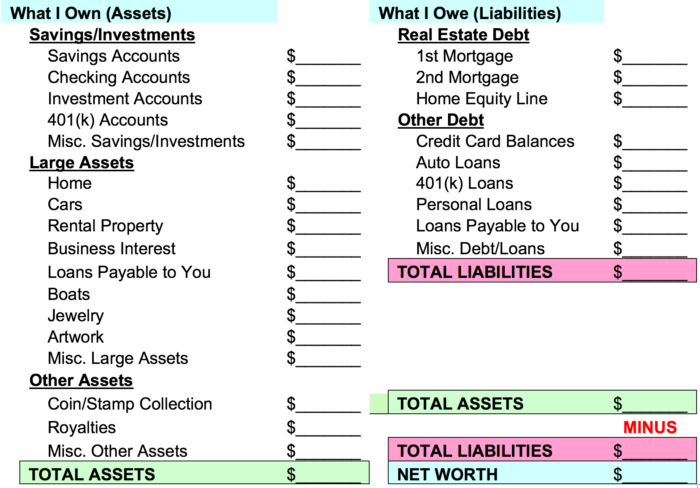

Use the worksheet below to help you calculate your net worth. You will need to list everything you own that fits each of the “What I Own” categories and then list everything you owe (e.g., credit card debt, mortgage, home equity loan, car loan, etc.) in the “What I Owe” column. Total both columns and subtract what you owe from what you own. Viola! Your net worth.

Net Worth Worksheet

Your net worth is a snap-shot of your financial health.

If you calculated it yesterday or tomorrow, it probably would be a different number—maybe better and maybe worse. The point is your net worth is constantly changing. If you own more than owe, you have a positive net worth and you are financially healthy. If, however, you owe more than you own, you have a negative net worth and are financially unhealthy. The good news is that you can become financially fit by increasing your net worth in one of three ways:

1.) Increase what you own. This doesn’t mean you should buy everything in sight. Remember, only savings/investment accounts, large assets, or assets that appreciate or produce an income are included in your net worth. Everything else is just stuff. When you buy an iPod or a new business suit, you are decreasing your net worth. Why? You are converting cash into something that isn’t included in your net worth. If you go on a shopping spree and buy $300 worth of clothes, you have reduced your net worth by $300. You may be thinking, “If I buy the clothes on a credit card, it won’t decrease my cash and I won’t be decreasing my net worth.” Nice try. Although you aren’t decreasing what you own, you are increasing what you owe by $300.

2.) Decrease what you owe. You can decrease what you owe by not borrowing money or using a credit card and by paying off your debt. Every dollar you’re able to reduce what you owe is a dollar you are using to increase your net worth.

3.) Increase what you own AND decrease what you owe. Why do one or the other if you can invest in assets and pay off your debt. If you’re serious about improving your financial health, this is exactly what you should do!

Because net worth changes over time and because your goal is to increase your net worth, you should monitor and track your progress on a regular basis. The best and easiest time to do this is during a monthly/quarterly meeting, which you will learn about in future lessons.

The proceeding blog post is an excerpt from The Six-Day Financial Makeover: Transform Your Financial Life in Less Than a Week!, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.