Have you heard of the caveman who was analytical, measured in his approach, and focused on long-term goals rather than short-term dangers?

No? Yeah, me neither. That dude didn’t live to be 12 years old. He’s not a caveman, he’s a cave boy.

All those wonderful personality characteristics would serve that cave boy today as a CEO or professional investor, but back then, in the face of constant dangers and threats, his highly emotional and act first and then ask questions later buddies survived through dinner.

And unfortunately for us today, these qualities of patience, analytical thinking, and long-term focus have only been developed recently in our evolution.

Investing takes certain qualities, such as taking a measured and analytical view rather than an emotional one and focusing on long-term goals that may be years or even decades in the future as opposed to what’s happening right now.

For all you Trekkies, we are much more like the highly charged Dr. McCoy than we are Dr. Spock.

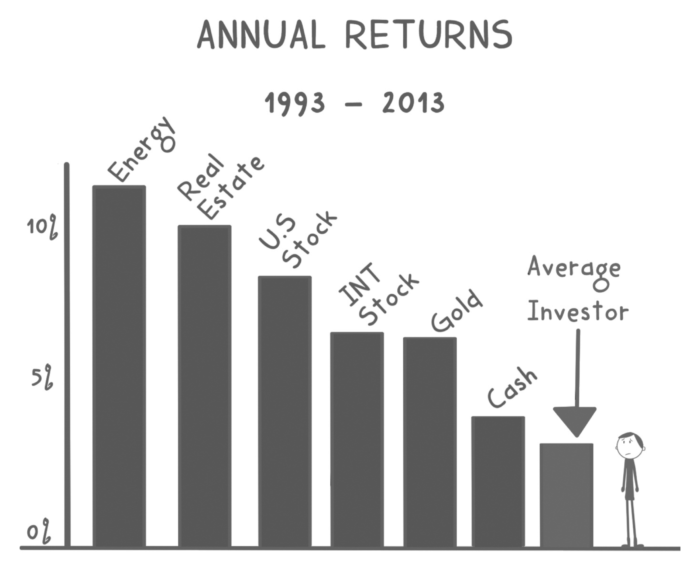

Let’s have a look at these returns.

Investors did terribly. It’s as if someone took a $1 bill, $2 bill, $5 bill, $10 bill, $20 bill, and a $100 bill and put them all in a bag, shook it up, and then said, “Reach in, and grab yourself one bill.” The average investor would reach in and pull out 50 cents.

Why do they do so badly, and more importantly, how can you do better?

- Know your risk tolerance. This will help ensure that you don’t have a portfolio that is too risky for your stomach.

- Stay grounded. This means don’t celebrate the gains and keep a long-term view on investing.

- Don’t market time. Trying to get out of the market and then back in at all the right times is impossible. And what’s our lesson? How to become a millionaire? Start with a billion dollars and then try to time the market.

- Don’t believe the hype. Monitor your investments, but don’t obsess over them. You have the ability to track your portfolio’s every move minute by minute, but that won’t keep you grounded. Check in each month and quarter, but don’t get too crazy over watching everything all the time.

I’m trying to keep this G-rated, but I have to talk to you about pornography in the next lesson, and it’s not going to be pretty.

The proceeding blog post is an excerpt from Get Money Smart: Simple Lessons to Kickstart Your Financial Confidence & Grow Your Wealth, available now on Amazon.

About the Independent Financial Advisor

Robert Pagliarini, PhD, CFP® has helped clients across the United States manage, grow, and preserve their wealth for nearly three decades. His goal is to provide comprehensive financial, investment, and tax advice in a way that is honest and ethical. In addition, he is a CFP® Board Ambassador, one of only 50 in the country, and a fiduciary. In his spare time, he writes personal finance books. With decades of experience as a financial advisor, the media often calls on him for his expertise. Contact Robert today to learn more about his financial planning services.